Farm equipment depreciation calculator

Depreciation is the allocation of cost of an asset among the time periods when the asset is used. Total annual ownership cost is the sum of depreciation interest and TIH.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and.

. This tool allows you to calculate ownership and operating costs of common farm equipment. Divide the balance by the number of years in the useful life. Land loans are still closed and serviced locally.

Apply when it is convenient for you and receive a response within three business hours. You can calculate the depreciation rate by dividing one by the number of years of useful lifean item with a useful life of five years has a 20 depreciation rate. The balance is the total depreciation you can take over the useful life of the equipment.

If Bob elects to use 150 percent-declining balance then his first year allowed. The MACRS Depreciation Calculator uses the following basic formula. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

Use the drop-down list to choose the power unit or self-propelled machinery that will be used. We welcome your comments about this publication and suggestions for future editions. 7 6 5 4 3 2 1 28.

You can send us comments through IRSgovFormCommentsOr you can. Next youll divide each years digit by the sum. 1 CWRS wheat is 625 per bushel in northern Alberta so it takes 24000 bushels just to cover the depreciation costs.

California has very specific rules pertaining to depreciation and limits any Section 179 to 25000 Maximum per year. It offers a secure simple online process so you can move quickly on a land sale or easily start a refinance. In this example total annual ownership cost is 7060 sum of depreciation 3985 interest 1196 TIH.

For example the cost of a machine that is used to produce products during several production. A calculator to quickly and easily determine the appreciation or depreciation of an asset. Depreciation rate 1 useful life If an asset with a useful life of five years and a salvage value of 1000 costs you 10000 the total depreciation in the first year is 1800.

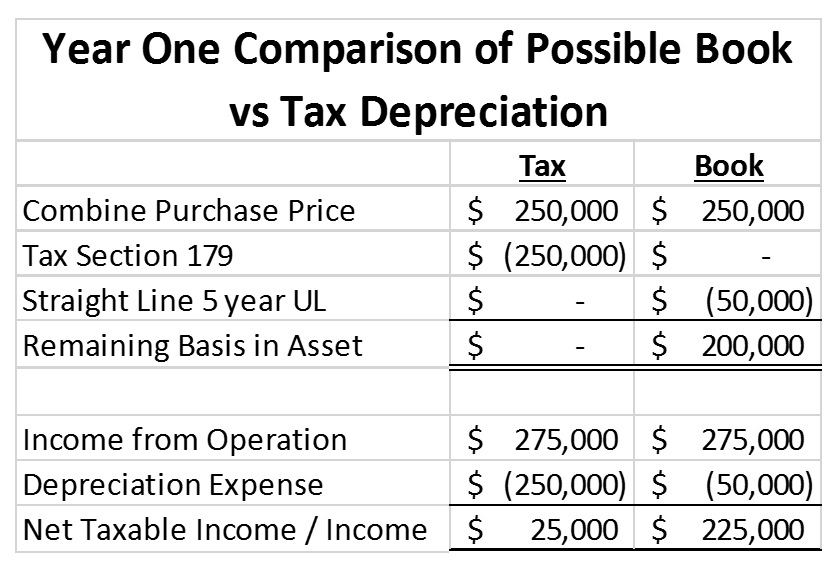

Assume the new machine costs 750000 and fair market depreciation for the first few years is 20 per cent per year so in the first year alone the depreciation cost is 150000. This gives you the. Use the Below Calculator to Check Your Tax Write Off The Section 179 Tax Deduction encourages agri businesses to stay competitive by purchasing shortline equipment which brings choice.

Bobs default depreciation will be 200 percent-declining balance which in the first year is 8000 40000 x 020. The first step to figuring out the depreciation rate is to add up all the digits in the number seven. Section 179 Tax Deduction for Farm in California.

In late August 2020 the cash price for No. In other words the.

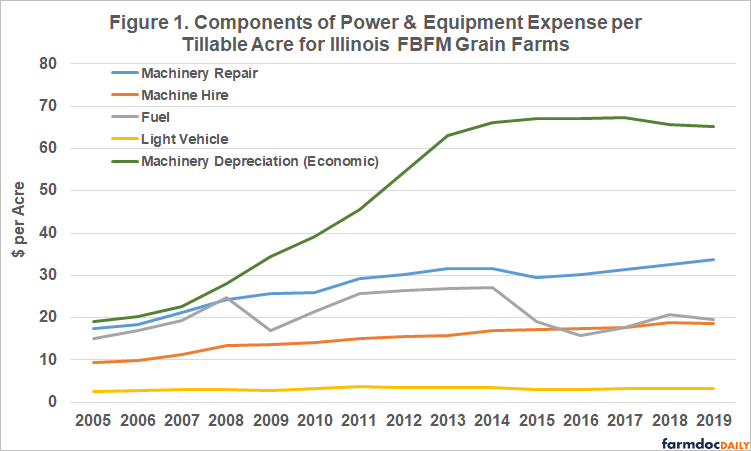

The Impact Of Power And Equipment Costs On Illinois Grain Farms Farmdoc Daily

Depreciating Farm Property With A 20 Year Recovery Period Center For Agricultural Law And Taxation

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

2018 Tax Reform What It Means For Agriculture

Pin On Agricultural Machinery

Farm Machinery Costs And Custom Rates Center For Commercial Agriculture

Revaluation Method Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

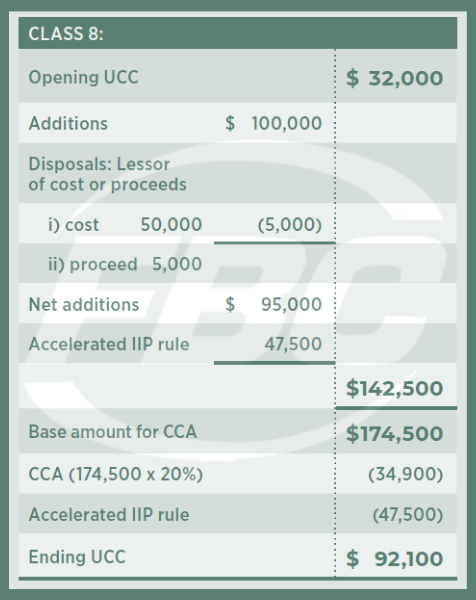

Capital Cost Allowance For Farmers Fbc

Pdf Estimating Farm Tractor Depreciation Tax Implications

Depreciation Formula Calculate Depreciation Expense

Types Of Accounts Accounting Simpler Enjoy It Learn Accounting Accounting Capital Account

A Small Farm May Be An Ongoing Family Venture Or A New But Growing Business That Will Eventually Become A Full Time Sou Grow Business Tax Write Offs Small Farm

Depreciating Farm Property With A 10 Year Recovery Period Center For Agricultural Law And Taxation

Pdf Estimating Tractor Depreciation And Implications For Farm Management Accounting

Depreciation What It Is And How To Use It Cropwatch University Of Nebraska Lincoln

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Depreciation And Farm Machinery A Rule Of Thumb Grainews